Thursday, April 24, 2014

Tuesday, March 18, 2014

We Have Exciting News - Introducing The Local Credit Union

Serving Macomb, Oakland & Wayne Counties

Dear Valued Members:

We are pleased to make an important announcement that will mark a milestone in our credit union's history. Sterling Van Dyke Credit Union has applied for and been granted permission from both the National Credit Union Administration (NCUA) and the State of Michigan, Department of Insurance and Finance Services to adopt a new name. We will begin the process of changing our name on April 1, 2014, and the name we have selected and are pleased to announce will be:

' The Local Credit Union '

This decision emerged from many months of research and evaluation under the leadership of our Board of Directors and executive team. Through this process, we have conducted research with credit union members, community members, union local members and credit union staff.

Sterling Van Dyke is very proud of our history and our heritage. In 2006, the credit union started expanding its charter. Over the past seven years, we worked toward expanding membership in the tri-county area that has been met with mixed results. The credit union has decided to focus not only on our new valued members, but re-focus on the members that started the credit union in 1949, our union members. A name that can appeal to everyone in our field of membership was chosen. The term "The Local" can satisfy both targeted audiences and eliminates the confusion of our credit union being located on Van Dyke Avenue.

You are and always will be the most important reason for our success. Our name is changing, but our employees and the high level of personal service we provide will continue. We have built this credit union on your loyalty and we thank you for your support and confidence in us.

We are excited about this new milestone in our credit union's history and we invite you to share in the celebration as we embark on this new journey together. Below we have provided a question and answer sheet with this letter to help address any questions you may have regarding this announcement. For further inquiries, please feel free to contact me at 586.264.1212.

Sincerely,

Joseph F Hallman, CEO

Location:

Sterling Heights, MI, USA

Friday, January 24, 2014

Sterling Van Dyke Credit Union Debt Consolidation Loans as low as 6.5%

Sterling Van Dyke Credit Union

39139 Mound Road

Sterling Heights MI 48310

39139 Mound Road

Sterling Heights MI 48310

Call Us @ 586-264-1212

_____________________________________________________

Find Us Online:

Wednesday, November 27, 2013

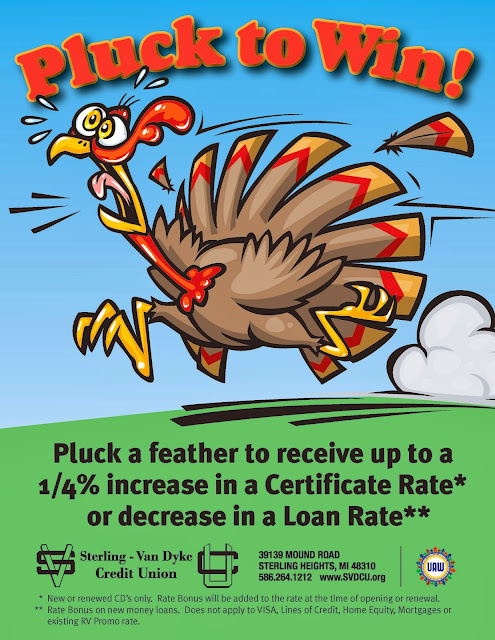

Pluck to Win 1/4% Decrease in a Loan Rate!

Sterling Van Dyke Credit Union

39139 Mound Road

Sterling Heights MI 48310

39139 Mound Road

Sterling Heights MI 48310

Call Us @ 586-264-1212

_____________________________________________________

Find Us Online:

Monday, September 30, 2013

Rates So Low It's Scary!!!

AUTO LOAN SPECIAL!

Rates as low as 1.74%* annual percentage rate.

*The lowest rate based on 2009 or newer vehicles, subject to term and credit to qualified members. Promotional rate not to be combined with any other offer/promotion and is subject to change without notice. Offer expires Oct. 31, 2013.

Thursday, August 8, 2013

Exploring Your Options: Traditional IRA's Vs. Roth IRA's

Traditional IRA's:

More Information:

Traditional IRA:

You are not eligible to contribute to a Roth IRA, but you can contribute $5,000 to a Traditional IRA. The ability to deduct your Traditional IRA contribution will depend on your active participation status.

Traditional/ Partial Roth:

You are eligible for a partial contribution to a Roth IRA. But you can contribute to a Traditional IRA. The ability to deduct your Traditional IRA contribution will depend on your active participation status.

Traditional/ Roth:

You are eligible for either a full contribution to a Traditional IRA or a full $5,000 contribution to a Roth IRA.

Roth IRA:

You are eligible for a full contribution to a Roth IRA. You are not eligible to deduct your contribution to a Traditional IRA.

Roth/ Partial Traditional:

You are eligible for a full contribution to a Roth IRA. You are eligible to deduct only part of your contribution to a Traditional IRA.

Address:

Sterling Van Dyke Credit Union

39139 Mound Road

Sterling Heights MI 48310

Contact us by email at info@svdcu.org.

Website: www.svdcu.org

- Contributions often are tax-deductable.

- Earnings grow tax-deferred.

- Distributions generally are taxable.

- Distributions before you reach age 59 1/2 are subject to penalty unless you meet an early distibution penalty exception.

- Required minimum distributions must begin at age 70 1/2.

- Contributions are not deductable.

- Earnings grow tax-deffered

- Contributions generally can be distributed tax-free at any time.

- Earnings can be distributed tax-free if the Roth IRA holder first made a Roth IRA contribution at least five years ago, and is 59 1/2, disabled, deceased, or paying first time home-buyer expenses.

- Distributions are not required until after the Roth IRA holder dies.

More Information:

Traditional IRA:

You are not eligible to contribute to a Roth IRA, but you can contribute $5,000 to a Traditional IRA. The ability to deduct your Traditional IRA contribution will depend on your active participation status.

Traditional/ Partial Roth:

You are eligible for a partial contribution to a Roth IRA. But you can contribute to a Traditional IRA. The ability to deduct your Traditional IRA contribution will depend on your active participation status.

Traditional/ Roth:

You are eligible for either a full contribution to a Traditional IRA or a full $5,000 contribution to a Roth IRA.

Roth IRA:

You are eligible for a full contribution to a Roth IRA. You are not eligible to deduct your contribution to a Traditional IRA.

Roth/ Partial Traditional:

You are eligible for a full contribution to a Roth IRA. You are eligible to deduct only part of your contribution to a Traditional IRA.

Address:

Sterling Van Dyke Credit Union

39139 Mound Road

Sterling Heights MI 48310

| Phone: (586)264-1212 Sterling Heights (800)974-6478 Toll Free (586)264-9447 Fax |

Hours: MON and WED 9:00am - 4:30pm TUE 10:00am - 4:30pm THURS 9:00am - 5:30pm FRI 8:00am - 6:00pm |

Website: www.svdcu.org

.jpg)

.jpg)

.gif)

Follow Us on Twitter

Follow Us on Twitter Visit Us on Blogspot

Visit Us on Blogspot.gif)